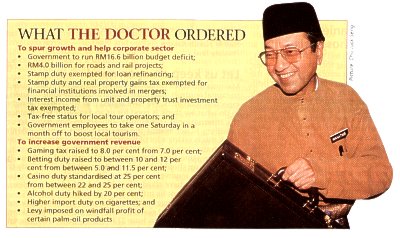

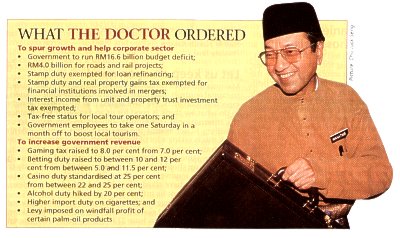

Prime Minister and First Finance Minister Datuk Seri Dr Mahathir Mohamad has presented a 1999 government budget that aims to support businesses and steer the economy out of recession thhrough a big deficit financing.

Prime Minister and First Finance Minister Datuk Seri Dr Mahathir Mohamad has presented a 1999 government budget that aims to support businesses and steer the economy out of recession thhrough a big deficit financing.

Prime Minister and First Finance Minister Datuk Seri Dr Mahathir Mohamad has presented a 1999 government budget that aims to support businesses and steer the economy out of recession thhrough a big deficit financing.

Prime Minister and First Finance Minister Datuk Seri Dr Mahathir Mohamad has presented a 1999 government budget that aims to support businesses and steer the economy out of recession thhrough a big deficit financing.

"lt's a budget to facilitate and support bussiness" he told Journalists at Parlia-ment House on today. "We want them to make profit and not to be bur-dened by things like non-per-forming loans (NPL). If they are able to do bussiness, 28 per cent of their profits go the government (in terms of corporate tax). Pan of the reason why the government has a deficit budget this year is a lot of them lose money."

While analysts have described the Budget as "caring", "compassionate", "lean", "pragmatic" and even "unexciting", it contained no surprises - except for the tax reform measure to introduce self-assessment and to change the basis of taxation from a preceding-year to a current-year.

Says Bank Negara Crovernor Tan Sri All Abul Hassan Sulaiman: "It's a budget that brings about economic recovery for all section"

Government sources say the government plans to borrow RM4.0 billion locally from bodies like the EPF to finance the deficit with the remaining RM12 billion to be sourced overseas. Japan is expected to lend US1.8 billion (RM7.0 billion) while the rest may come from multilateral organisations like the World Bank and Asian Development Bank once they get a clearer picture of the country's exchange control measures. The sources also say that Salo-mon Smith Barney, financial advisor to the government, believes that conditions will likely be conducive for the government to tap the international bond market only in the second half of 1999.

The 1999 Budget strategy is aimed at:

Some of the measures to support the above strategy have already been implemented this year. These include the introduction of capital controls to stabilise the ringgit; the reduction of interest rates, increase of liquidity and reclassification of NPLs to assist troubled banks and businesses; and the relaxation on loans for the purchases of vehicles and houses to encourage consumer spending and demand in the respective sectors.

At the same time, the government has established an asset management company Danaharta and a special-purpose vehicle Danamodal to take care of the NPLs and to assist and recapitalise troubled banks. Danaharta will require a total funding of RM15 billion and will acquire up to RM8 billion of NPLs from 21 financial institutions by the end of 1998. Of the RM16 billion required by Danamodal, Bank Ne-gara will provide RM3 billion as seed capital.

The Corporate Debt Restructuring Committee, on the other hand, will assist viable Malaysian corporations from being forced into liquidation as the result of the regional financial crisis. In addition, the 1998 budget was increased by RM17 billion to stimulate the economy by reviving some infrastructure projects.

To assist further development of infrastructure projects (which will have spin-off benefits to 120 industries related to produ-cing building materials) and revive the construction and manufacturing sector, the government in the 1999 Budget has proposed to change Bank Pembangunan into a new entity called Bank Pembangu-nan dan Infrastruktur Malavsia, which has a paid-up capital of RM11 billion.

The Budget also sees the continuation of assistance to low-income groups, petty traders and small businessmen, whereby the Amanah Ikhtiar Malaysia and Small Scale Entrepreneur Fund are allocated RM100 million and the Economlc Business Group Fund RMI5 million.

The Government will further stimulate businesses through the following tax proposed measures: Instruments that attract stamp duty for the refinancing of loans for business purposes be exempted from duty. This will reduce the cost of doing business;

These measures and others in the Budget as a package are expected to help the economy gain better footing and register a gross domestic product growth of 1.0 per cent in 1999, reversing the negative 4.8 per cent expected in 1998.

Member of Parliament for Wangsa Maju Datuk Dr Kamal Salleh considers the Budget as the continuation of the implementation of the National Fconomic Recoverv Plan by which the government opts to reflate the economy.

"There is greater involvement from the government in the economy than before but this does not mean it has abandoned the market forces. Of course, reflation could pressure inflation, but the government expects it to be manageable around 4.0 per cent in 1999."

Nevertheless, while the economy is expected to recover, there still exists risks which could lead to renewed votalitv. Dr Mahathir lists some of the risks: